hotel tax calculator bc

Current GST and PST rate for British-Columbia in 2021. Hotel Room Rates and Taxes.

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

The maximum MRDT rate is 3.

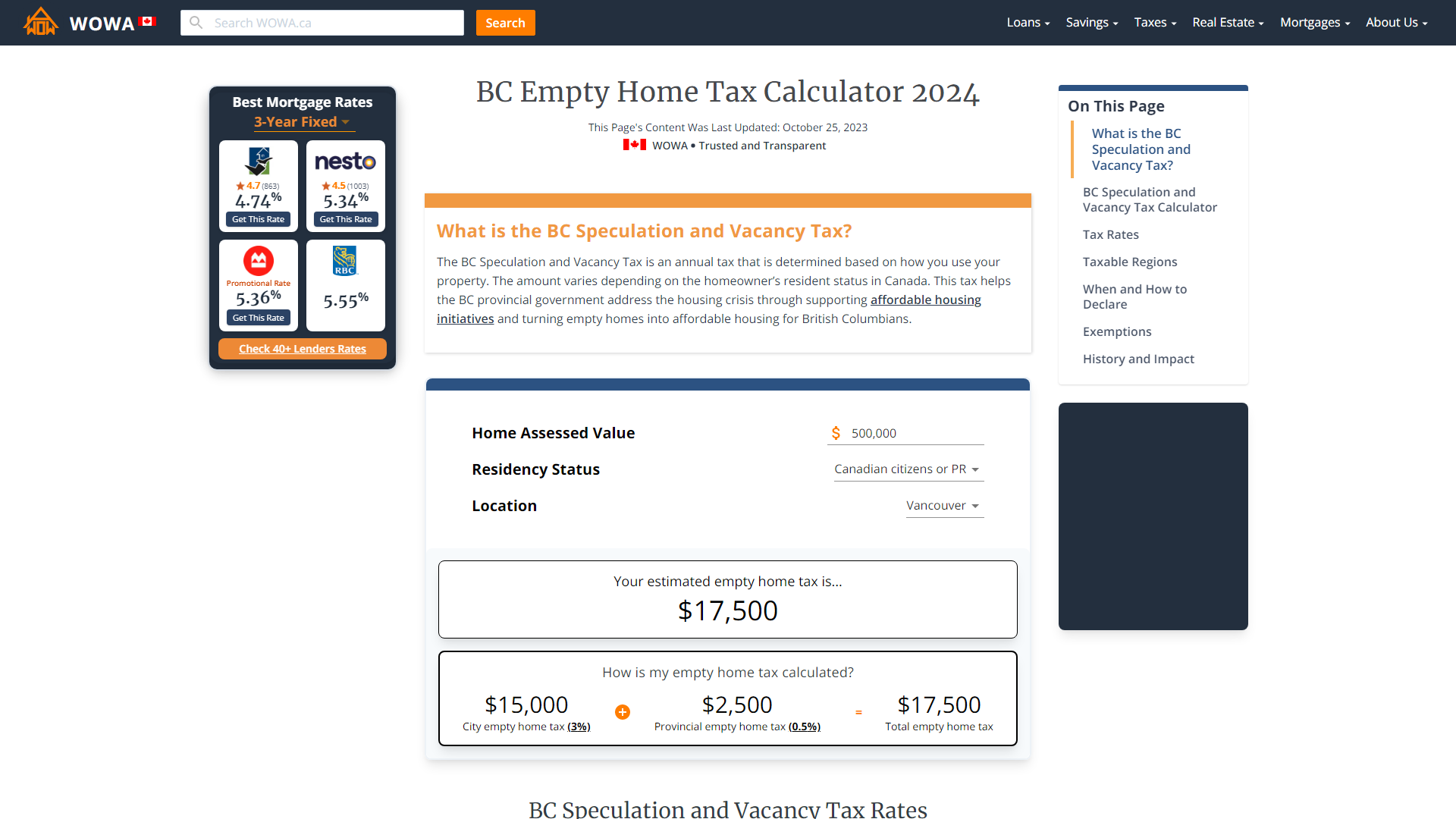

. 2 Municipal and Regional District Tax MRDT on lodging in 45 municipalities and regional districts. For example a foreign owner or. For the 2021 tax year individuals with an income below 21418 can deduct up to 481 from their income tax bill.

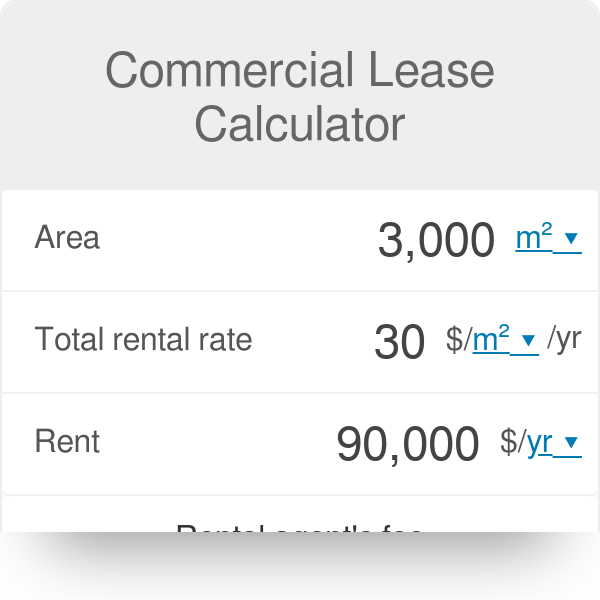

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations with four or more. That means that your net pay will be 38554 per year or 3213 per month.

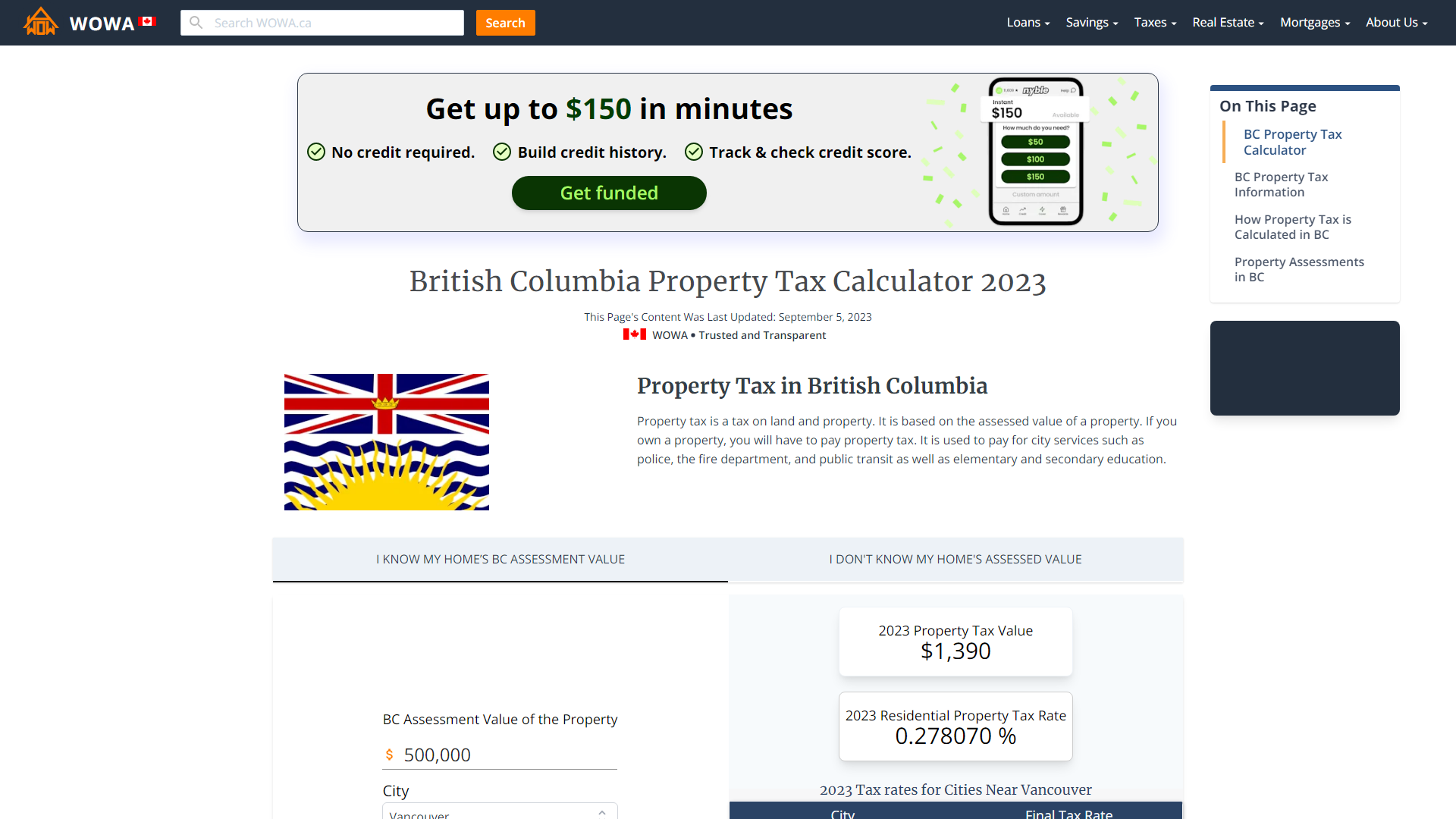

The following table provides the GST and HST provincial rates since July 1 2010. Current GST and PST rate for British-Columbia in 2022. Most goods and services are charged.

Their tax rates see MRDT Participating Municipalities Regional Districts and Eligible Entities below. Type of supply learn about what. In the province of British Columbia your tax rate can be as low as 506 if your annual income is 43070.

Provincial sales tax pst bulletin. 1 This regulation may be cited as the Hotel Room Tax Regulation. 2021 Income Tax Calculator Canada.

Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings. Alberta tax rates British Columbia tax bracket British Columbia tax rates Yukon tax bracket Yukon tax rates Northwest Territories tax bracket Northwest Territories tax rates Nunavut tax bracket. BC Speculation and Vacancy Tax Rates.

The rate you will charge depends on different factors see. In 2022 British Columbia provincial government increased all tax brackets and base amount by 21 and tax rates are the same as previous year. Avalara MyLodgeTax automatically applies updated retnal tax rates to customer bookings.

20 of the propertys assessed value for foreign owners satellite families and other non citizens or PR. In British Columbia an 8 Provincial Sales Tax PST is charged on all short-term room rentals by hotels motels cottages inns resorts and other roofed accommodations. 1 This regulation may be cited as the Hotel Room Tax Regulation.

Hotels in most parts of BC will be 15 5 GST 8 PST short term accommodaton only 2 MRDT formerly known as Hotel Tax. Base amount is 11302. Calculate the total income taxes of the British Columbia residents for 2021.

The global sales tax for Bc is calculated from provincial sales tax PST BC rate 7 and the goods and services tax GST in Canada. The british columbia annual tax calculator is updated for the 202223 tax year. Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it.

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 13446. However this tax credit is reduced by 356 for income above. Hotels in most parts of BC will be 15 5 GST 8 PST short term.

To increase the rate in their area participating. And as high as 205 if your income is over 227091. British Columbia is one of the provinces in Canada that charges separate 7 Provincial Sales Tax PST and 5 federal Goods and Services Tax GST.

Ad Avalara MyLogdeTax calculates rates for your bookings so you dont have to think about it. GST 5 PST 7 on most goods and services. 21 In this regulation unless the context otherwise requires section 1 of the Act shall apply.

21 In this regulation unless the context otherwise requires section 1 of the Act shall apply. Your tax per night would be 1950.

Home Equity Loans Approved In 24 Hrs Debt Consolidation Refinances And Second Mortgages Private Mortgage An Hipotecas Prestamo Hipotecario Comprar Vivienda

Ontario Sales Tax Hst Calculator 2022 Wowa Ca

Taxes For Rentals Travel Advice Travel Resources Travel British Columbia

Calculating Controlling Your Hotel Operating Costs Qwick

Tipping In Canada Things To Know As A Newcomer Arrive

Download Accounting Flat Banners For Free Accounting Vector Free Goods And Services

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

How To Calculate Wages 14 Steps With Pictures Wikihow

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Fha Changes May Tighten Credit For Homebuyers Realestateagent Firsttimehomebuyer Massachusetts Massachusetts Association Of Buyer Agents Financial Management Business Insurance Investing

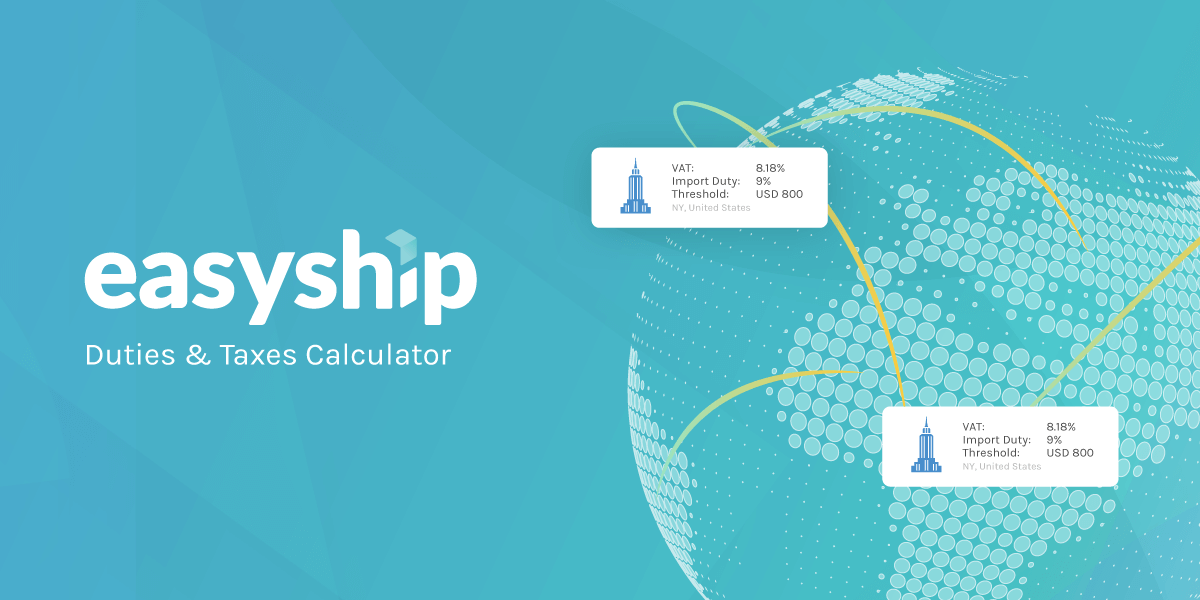

Calculate Import Duties Taxes To Canada Easyship

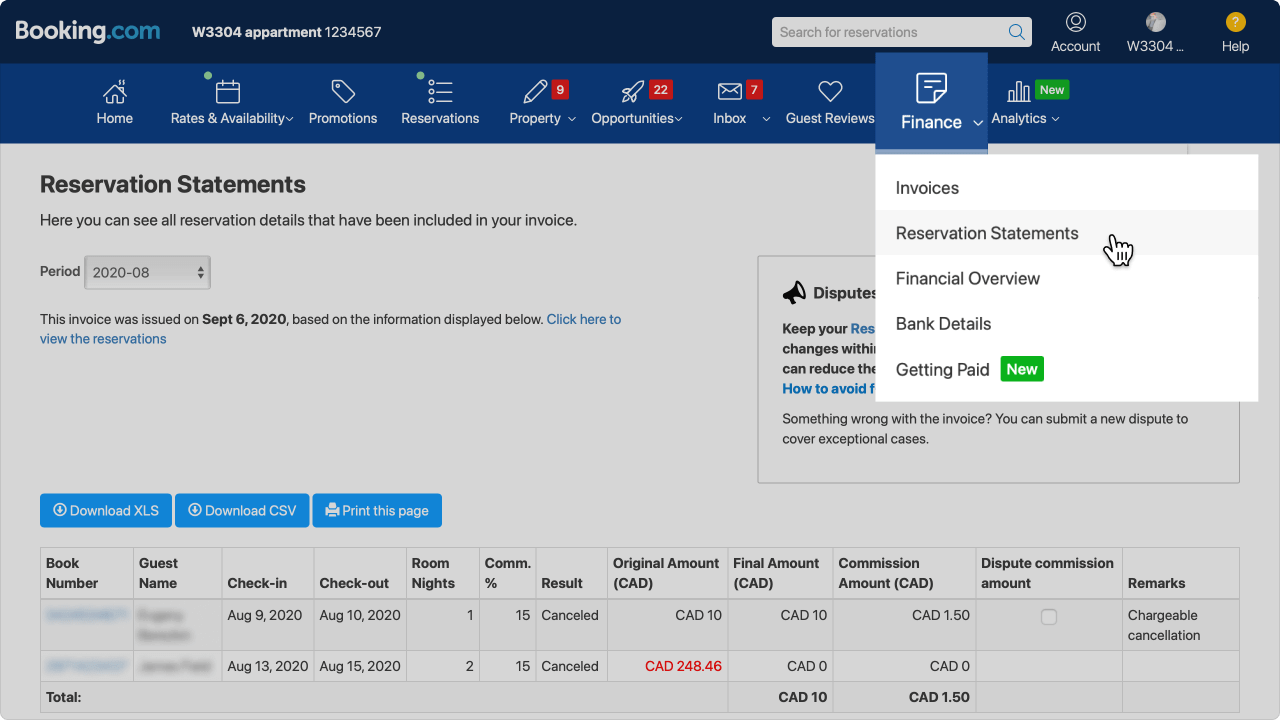

Booking Com Fees How Much Should I Pay As A Host Igms

Calculating A Least Squares Regression Line Equation Example Explanation Technology Networks

British Columbia Gst Calculator Gstcalculator Ca